By Ashley Alford

Budgeting is a critical skill for college athletes who are managing their finances amidst the demands of their athletic commitments and academic responsibilities. As student-athletes navigate the complexities of college life, expenses such as tuition, housing, meals, and other day-to-day costs can add up. Having a well-planned budget becomes essential for financial stability and long-term success. A thoughtful budget allows athletes to allocate their limited resources, track their income and expenses, and make informed decisions about spending and saving. By adopting disciplined budgeting practices, college athletes can not only ensure they meet their financial obligations but also establish a solid foundation for their future financial well-being, both during their collegiate years and beyond.

Create a Budget: Establish a budget to track income and expenses.

Here’s an explanation of how to create a budget and an example to illustrate the process:

1. Assess Income: Start by identifying all sources of income, such as athletic scholarships, stipends, part-time jobs, or financial support from family. Determine the frequency and amount of each income source. Make sure to consider any taxes or deductions that may apply to your income.

2. Track Expenses: Keep track of your expenses for a certain period, such as a month. Categorize your expenses into different categories like housing, utilities, transportation, groceries, entertainment, education-related expenses, and debt payments. Gather receipts, bank statements, and credit card statements to ensure accuracy.

3. Differentiate Needs vs. Wants: Review your expenses and distinguish between essential needs and discretionary wants. Needs include items like rent, utilities, food, and transportation. Wants include non-essential items or experiences like dining out, entertainment subscriptions, and shopping. Prioritize your needs while being mindful of wants.

4. Set Financial Goals: Determine your short-term and long-term financial goals. Short-term goals may include building an emergency fund, saving for a specific purchase, or paying off debt. Long-term goals may involve saving for post-college plans, retirement, or investments. Establishing clear goals helps guide your budgeting decisions.

5. Allocate Funds: Allocate your income to different expense categories based on your needs, wants, and financial goals. Start by covering essential needs and mandatory expenses. Then, distribute funds towards savings and debt payments. Finally, allocate remaining funds to discretionary expenses.

6. Monitor and Adjust: Keep track of your spending throughout the month to ensure you stay within your budget. Regularly review your budget and make adjustments as necessary. If you find that you’re consistently overspending in certain categories, consider reevaluating your priorities or finding ways to reduce expenses in those areas.

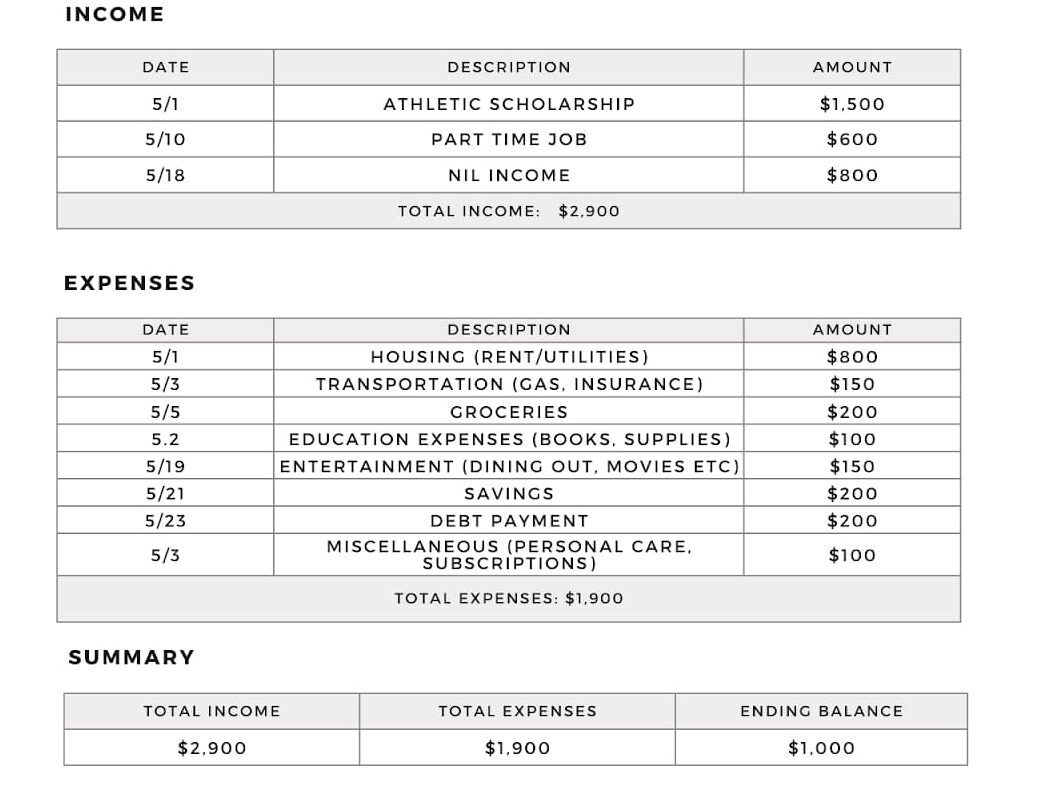

Example Budget:

In this example, the athlete has allocated their income to various expense categories and has $1,000 remaining at the end of the month. If there is a surplus, it can be allocated towards savings or other financial goals. If there is a deficit, adjustments may need to be made by reducing discretionary expenses or finding additional sources of income.

Remember, this is just an example, and your budget should be tailored to your specific income, expenses, and financial goals. Regularly review and adjust your budget as needed to ensure it aligns with your evolving financial situation and priorities.

Control Spending: Be mindful of spending habits and avoid unnecessary expenses. Differentiate between needs and wants to make informed spending decisions. It’s essential to strike a balance between enjoying college life and being financially responsible. Controlling spending is a crucial aspect of financial management for college athletes. It involves being mindful of your spending habits and making informed decisions about where your money goes. Here’s an expanded explanation and an example to differentiate between needs and wants:

1. Needs: Needs are essential expenses required for basic survival and well-being. These expenses are typically necessary and non-negotiable. Examples of needs include:

- Housing: Rent or mortgage payments, utilities (electricity, water, gas), and insurance.

- Food: Groceries and essential household supplies.

- Transportation: Commuting expenses, such as gas, public transportation fares, or car payments.

- Education: Tuition fees, books, and educational supplies directly related to your coursework.

- Healthcare: Medical insurance premiums, prescription medications, and necessary healthcare expenses.

Needs are generally non-negotiable and should be prioritized in your budget since they are essential for your well-being and academic success.

2. Wants: Wants refer to discretionary expenses that are not essential for basic survival but add enjoyment or convenience to your life. These expenses are typically more flexible and can be adjusted based on your financial situation. Examples of wants include:

- Entertainment: Eating out at restaurants, going to movies, concerts, or sporting events, and recreational activities.

- Travel: Vacations, weekend getaways, or non-essential travel expenses.

- Shopping: Non-essential clothing, accessories, gadgets, or luxury items.

- Subscriptions: Entertainment subscriptions like streaming services, magazine subscriptions, or gym memberships.

Wants are optional expenses that can provide enjoyment and enhance your college experience. However, it’s important to balance these expenses with your financial goals and prioritize them accordingly.

By distinguishing between needs and wants, the athlete can evaluate the urgency and importance of the purchase and make an informed decision based on their financial priorities and available resources.

It’s essential to strike a balance between needs and wants. While it’s important to enjoy college life and treat yourself occasionally, being mindful of your spending habits and focusing on meeting your needs first can help you maintain financial stability and work towards your long-term financial goals.

Plan for Taxes: Understand the tax implications of income earned from scholarships, stipends, and other sources. Consult with a tax professional to ensure compliance and determine the best strategies to minimize tax liability. Consult the Basepath Tax Guide for more information.

Budgeting is a fundamental aspect of financial management for college athletes. By developing and adhering to a well-structured budget, athletes can gain control over their finances, minimize financial stress, and work towards their long-term goals. A carefully planned budget empowers athletes to make informed financial decisions, prioritize their spending, and set aside funds for savings and emergencies. It allows them to strike a balance between enjoying their college experience and being financially responsible. As college athletes embark on their athletic and academic journeys, integrating budgeting practices into their daily lives will contribute to their overall financial well-being and set them on a path towards a successful future.